10 Fundamentals About business tax preparer near me You Didn't Learn in SchoolPosted by Hession on January 21st, 2021

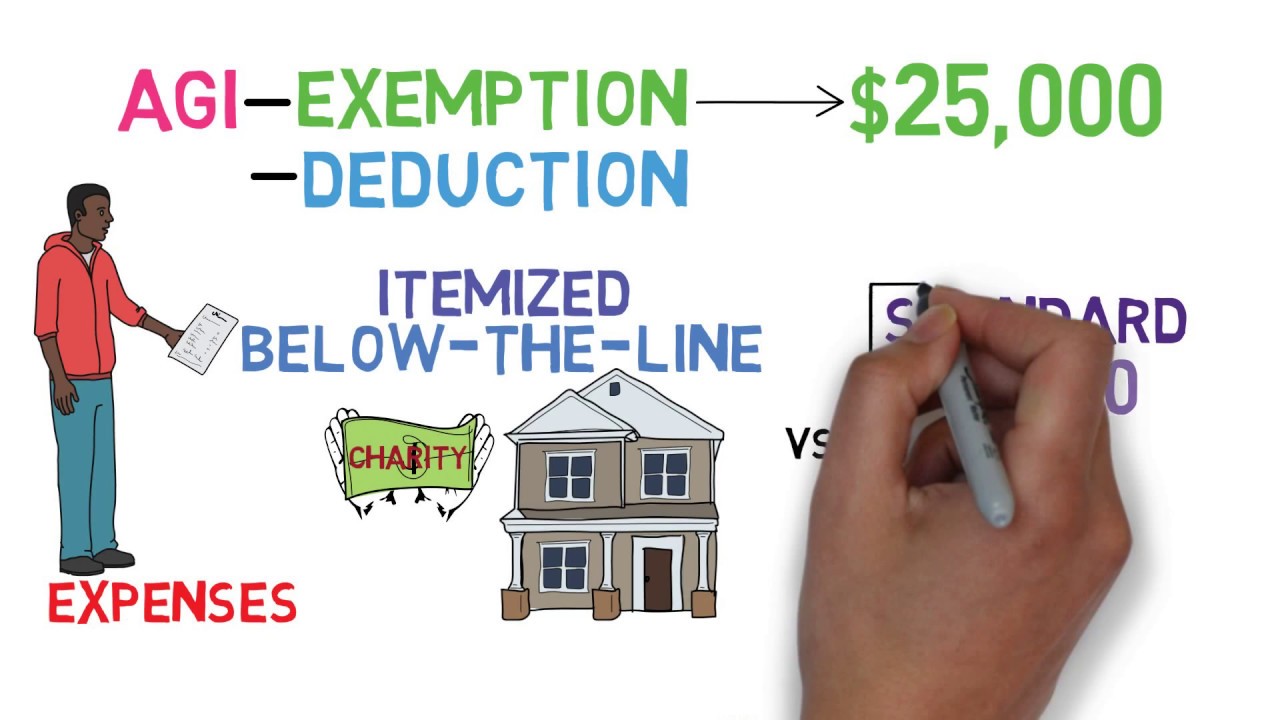

It's important to surround yourself with the proper folks. A wise mentor. An inviting perfect buddy. And, yes, a really excellent tax advisor. After all, once the worry of tax season starts to smother you in its own icy cold embrace, not want an honest tax pro onto your own negative? Some body who can help you solve your entire tax concerns and problems? Of course you are doing! But locating a tax adviser you are able to count on isn't as straightforward since it was. So, what does a trustworthy tax consultant appear to be? And how would you will find anyone nearby you? We're going to do a deep dive on the vital characteristics and things to search for tax return preparer near me in a tax expert. But first, let's look at why you want one at the first spot. Why Assist a Tax Advisor? Tax yields really are like snowflakes--no 2 are alike! By the range of kiddies you have playing throughout your home to all those strange tasks you chose this year to pay debt off more rapidly, there are scores of factors that'll impact simply just how far you may owe to Uncle Sam and simply how much it is possible to save your taxes from year to year. Some folks have an easy situation--they can file their taxes with some online tax computer software. However occasionally you will be happy you looked to your pro for help. Here are some reasons why you really Most Likely Want to consider Dealing using a tax adviser this season: You went through a big life change. Got married? Had an Infant? Congrats! Your tax position is probably going to change, so you're going to definitely want to provide your tax pro a call once you are back from your honeymoon or fully stocked up on diapers. You'd multiple sources of revenue or began a small business enterprise. That additional funds you earned from sending your new wedding pictures business really is fine! But this also means that you might have to manage different tax forms and issues which you have not coped with previously. You are focused on maybe not getting the taxes done right. There are few words from the English terminology that are scarier when put together than"tax audit" After all, nobody would like to have their own monetary living picked apart by the IRS. Having an tax advisor to guide you personally and allow you to record your own taxes correctly will permit you to breathe a little easier once Tax Day has come and gone. Still unsure whether or not you should have in touch with a tax advisor this year? Take our taxation quiz and figure out which alternative is most effective for you--it'll just have several minutes! What Do You Need to Look for in a Tax Advisor? Let's face itTaxes are as complicated because they really are boring. If you're having trouble sleeping through the night, get a replica of the U.S. tax code and then simply begin studying. That will knock out you real quick. But tax advisers --that the decent ones--aren't enjoy the rest of the us. They liveeat and breathe this substance. They truly are uptodate on every one of the latest changes and trends taking place in Tax World so that they can help you realize which tax legislation, credits and deductions affect one's. But looking to get a tax pro goes outside of mind understanding. Listed below are just eight significant attributes You Must Always Search for in a tax advisor before you consent to trust them with your taxation: 1. They're qualified and have the perfect certificates. When you're searching for a tax expert, you're going to wish to operate with a person that will supply you with quality information. To put it differently they know very well what the reverse they are undertaking! When it comes to getting tax advice, locate a pro who has one of the two certificates: Enrolled Agent: An Enrolled Agent can be an tax pro for those searching for expert tax return prep and tax advice. As well as, they've been licensed by the IRS to stand for you if you are staying audited. Licensed Public Accountant (CPA): Certified Public Accountants focus on tax preparation and planning, but they can also provide a bunch of other services that will allow you to all through the whole year --out of accounting into long-term financial planning. When your tax problem is actually complicated, a CPA can aid with information on tax strategies to follow in accordance with your circumstances. Enrolled Agents and CPAs both go through extensive education, schooling and ongoing training to maintain their credentials and remain uptodate on tax laws and regulations so that they could better last. Some one with only a preparer tax identification number (PTIN) is not planning to cut it. Fun reality: Each one among our taxation Endorsed neighborhood Providers (ELPs) is either an Enrolled Agent or a CPA. That means whenever you work with an ELP, then you can take a break sure that you are dealing with a top-notch expert! 2. They can be purchased annually. Nowadays, there certainly really are a lot of parttime, flybynight tax preparers showing up during tax time only to evaporate when they file your tax return, to not be heard from again. Not even on a Christmas card. Like we mentioned, things come about through the season which could have a significant effect on the best way to file your own taxes for this tax year. When life occurs, obtaining a reliable tax pro that will pick up the phone to answer your tax questions from September (maybe not simply January through April) can effect a significant impact. 3. They know your own financial goals. Wherever you are about the Baby Measures, it helps to have a tax adviser who's on the same wavelength as you can . This means that they take the opportunity to know about you as well as your economic goals, so they can give you taxation tips that may drive you nearer to reaching those goals. Whether they're working for you pay off debt faster during the year by adjusting your withholdings or helping you identify probable advantages and disadvantages of carrying your side hustle to the following degree, a excellent tax adviser is a person who is ever looking for techniques to help you move the ball further down the field. 4. They make time to answer your tax problems. When tax provisions such as"deductions" and also"itemizing" and"Adjusted Gross revenue" start getting thrown around, your own thoughts probably commences off to flood having questions. Do not stress, this is a totally normal response. Your tax adviser should remain ready to sit down with you and help you answer all your concerns regarding your own earnings. That is exactly what it suggests to have the core of a teacher! In the event you are requesting questions as well as your own tax advisor rolls their eyes or gives you a high-browed reply that renders you confused than you had been previously, it is probably time for you to start looking for a fresh adviser. 5. They've been proactive in communication with you personally. That you don't merely want somebody who sets a rubber stamp on your return and walks away. That is just idle. You require a tax ace who will take the initiative and maintain a look out for things you may possibly want to change to the approaching year. Did you get yourself a large refund? Nobody wishes to provide the authorities an past-due mortgage. Have you ever seen how they manage money? A great tax ace will choose enough time to spell out your company has already been taking too large an amount of money out of your paycheck for taxes and explain just how you can fix it. Or what if you got slapped with a significant tax invoice? Your expert needs to be able to explain why that was the case and how you are able to refrain from getting blindsided next calendar year. 6. They will be able to help you with business taxation. In the event you are in possession of your little company or if you're dreaming about starting one someday, it's easy to just forget about what that means when it has to do with your earnings. However, you are going to be happy that you own a tax pro who has experience dealing together with small-business owners and also will be able to help you navigate through business taxation prices, approximated taxes and which deductions you meet the requirements for a small business owner. 7. They can aid you along with your taxation following year... and the year then. Having a tax advisor you may turn to year after year can help you save from having to spell out the exact issues over and over again to a brand fresh random tax preparer every spring. Who's time for it? Besides, it is helpful to own a tax adviser who is aware of you and your taxation case enough to offer you solid ideas and tips that will assist you lower your tax statement. 8. They can be trusted with sensitive info regarding finances. Dealing with anybody you like to your taxes may be tempting, however you might not need Uncle Joey to be aware of simply how much you create, what size your house loan is and even how far you tithe to your church? That can make Thanksgiving supper kind of embarrassing! It really is crucial that you find a tax adviser you are able to trust with all the bolts and nuts on your own financial circumstance. Trust may be the base of almost any strong partnership --for example your relationship by means of your tax pro! Like it? Share it!More by this author |