Is it Good to Invest in Tata Equity P/E Fund for 5 Years?Posted by Dishika Baheti on October 5th, 2018

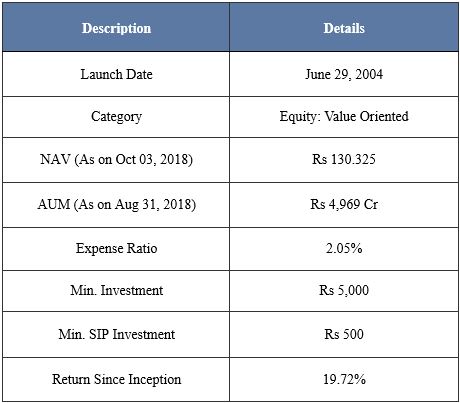

As the market shows negativity in the past month, many investors have shifted to value investing approach because several stocks quoted at premium prices have lost the values. This has made a tool for investors to navigate their investments in the value stocks in the volatile market. But at the same time, some investors are not prone to direct equity investments. For such investors, Tata Mutual Fund has bought Tata Equity P/E Fund, which invests particularly in the value stocks and delivering high returns as well.

Portfolio Placement and Investment Strategies Followed by Tata Equity P/E Fund (G) The fund is aiming at providing high returns to the investors and helping them in capital appreciation, and it has invested its corpus predominantly in the equity and equity-related securities, keeping approximately 5% in debt as well as money market instruments. The debt space provides mandate liquidity to it at any time of the market.

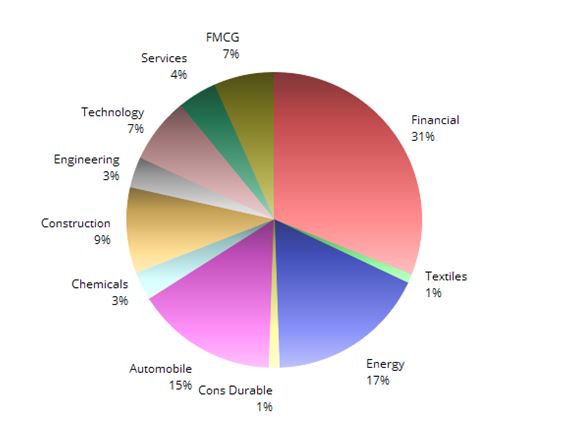

The fund is investing majorly in the finance, energy, and automobile sectors. Keeping the major portion of defensive and cyclical super sectors in the portfolio, it has assured low-risk for the investors in the overall market cycle and economy. It has a small proportion of sensitive sectors as well in its portfolio, which offer growth to the capital keeping a long-term perspective. As per the fund managers, they select the companies which have high capital efficiency and provide exposure to high-conviction bets. They are bullish on the companies which have sufficient liquidity and a healthy long-term track. Past Performance and Risk Measures of Tata Equity P/E Fund- Growth Plan

On the contrary, if we look at the risk measures of Tata Equity P/E Plan, it has delivered high alpha in the past three years when its peers have generated negative alpha. However, the Standard Deviation of the fund is higher than its benchmark as well as category, which depicts that it is riskier than other funds of the category. All these risk measures and returns show that the fund is best to invest with a long-term perspective. A five year investment horizon is best for it because it has given high returns in the five years in the past. However, the past performance of the fund is just for the knowledge, and we cannot depict how the fund will perform in the future. But, we saw that the management team of Tata Equity P/E Fund growth has been adopting the best approach according to the market which will help it to offer good returns to the investors over a period. Like it? Share it!More by this author |