U.S. Atherectomy Devices Market Increasing Demand And Forecast To 2025Posted by Neha Bora on March 2nd, 2020

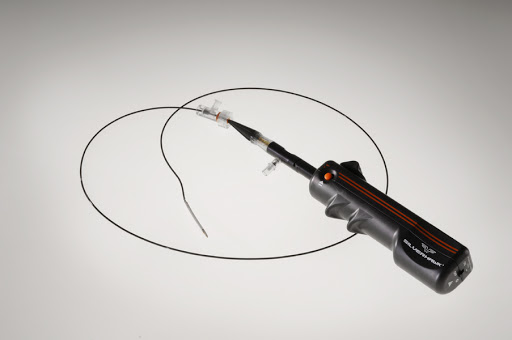

San Francisco, 2 March 2020: The Report U.S. Atherectomy Devices Market Size, Share & Trends Analysis Report By Type (Laser, Directional, Rotational, Orbital), By End Use (Office-based Labs, Out-patient Facility, In-patient Facility), And Segment Forecasts, 2019 – 2025 The U.S. atherectomy devices market size is expected to reach USD 626.1 million by 2025 expanding at a CAGR of 6.6%, according to a new report by Grand View Research, Inc. The regional market is expected to witness lucrative growth due to the rising prevalence of target diseases and preference for endovascular procedures. Moreover, rising demand for minimally invasive procedure will boost the market growth. Such procedures are less painful and allow quicker recovery than invasive procedures. Other advantages, such as higher patient satisfaction owing to fewer incision wounds, few post-surgical complications, and low mortality rates, are also driving the atherectomy devices market growth. Technological advancements allowing early diagnosis are also likely to augment the market growth in the near future. For instance, in January 2017, Medtronic received CE mark approval for HawkOne directional atherectomy system for treating patients suffering from Peripheral Artery Disease (PAD). Access Research Report of U.S. Atherectomy Devices Market @ www.grandviewresearch.com/industry-analysis/us-atherectomy-devices-market Further key findings from the study suggest:

Like it? Share it!More by this author |